If you look at the current trends in asset management, one topic comes up again and again: Robo Advisor. This digital trend in the banking sector will change the classical business model permanently and offers promising opportunities.

According to current forecasts, the value of the assets managed by Robo Advisor is expected to rise to 0.8 – 8.1 trillion dollars by next year. These figures make it necessary for banks on their way into the future to actively address this multifaceted issue.

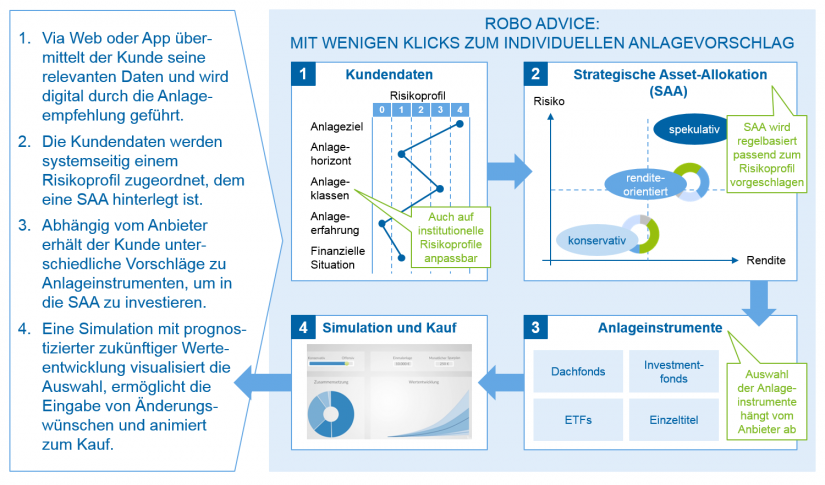

A Robo Advisor is digital and fully automated asset management, but most currently established solutions do not go that far. However, in the near future such intelligent, AI-driven interfaces can be expected, which create the optimal risk profiles depending on the customer and thus fully automatically invest money for the bank customer.

To optimize these processes, financial service providers need more customer data and optimized data management to optimize their portfolios. However, according to a recent study by Deloitte, the Robo Advisor is increasingly arriving in Germany. Currently, according to the study, approximately 480 billion euros of asset under management (AuM) are managed by such automated investors. This corresponds to approximately half of the German mutual fund market. The Top 5 Robo Advisors, Deloitte continues, manage around EUR 170 billion, which corresponds to a market share of around 40%. The growth of the industry is estimated at more than 2,300 billion euros AuM over the next five years.

However, the market development is still in its infancy because the intelligent consultants are still in their infancy. More and more founders are establishing themselves in this Fin-Tech sector and are expanding their services in cooperation with various banks. With an increase in performance and data quality, Robo Advisors can become even more interesting for the market in the future, which not only promises new service offerings, but also substantially increases the quality of financial services.